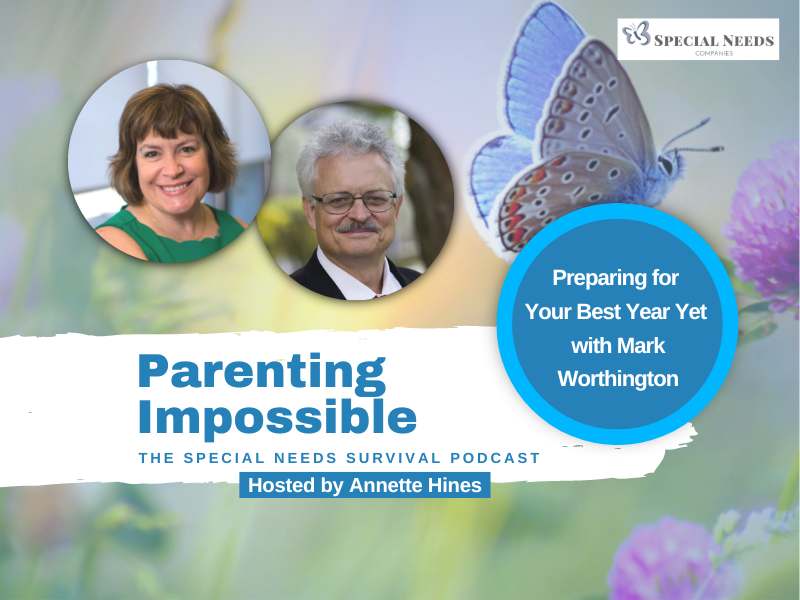

It’s our annual Preparing for Your Best Year Yet podcast episode featuring the planning duo of Special Needs Law Group of Massachusetts, P.C.: Host Annette Hines and her favorite podcast guest, her husband and law partner, Mark Worthington. In this episode, they provide tips for ensuring that your estate plan still works for you and meets your goals. Most of us complete our estate planning and put our documents on a shelf and do not look at them again for years. But things change and your plan needs to change with you. You can listen to previous year’s episodes about planning for the new year below:

- Year End Planning with Annette Hines

- How to Hit “Reset” in 2021 with Ian Adair

- Set Goals, Not Resolutions For 2022 with Tracey Ingle & Sarah Reiff-Hekking

- Preparing for Tax Season in the New Year with Host Annette Hines

Here are three questions that you should consider in preparing for your best year:

- What’s changed about your assets or your stuff? What’s your financial picture look like?

- How are you doing? What’s new or different about you or your people, not just those whom you love and are close to you, but those whom you’ve selected to put in charge of your decision-making when needed? Consider specific people named in the plan for roles such as trustees, financial or healthcare agents, agents for powers of attorney, etc.

- Have there been changes in the law? These are rare, and your attorney or planner will typically reach out to you regarding law changes that you might need to consider in your planning. Most recently, the years 2002, 2020, and 2022 have included changes in the law that impact financial and estate planning.

What are you looking for when you review your estate plan?

- Understand what your plan says. Often when Annette and Mark meet with clients to review a plan, the client see differences in what they anticipated the plan would say and what the documents themselves state.

- Review your assets or what you own. Examining your assets, Annette notes, is more than just considering cash in the bank. Make a concrete list of what you own. What accounts do you have? What’s in them? What’s the nature of them–retirement, non-retirement, real estate, digital, etc.? Do you have special items like stock options or investments/ownership in a company? What liabilities or debt do you have? Are you anticipating an inheritance soon? Do you own international property? What family items with special meaning do you own? Consider meeting with a financial planner who can help you organize and take stock of all of your assets, which is especially important for special needs families.

What is the best way to start understanding what your plan says?

Look to see if your planner included a cover letter, summary, or overview statement of the estate plan to guide you about the contents of the plan, which may include a recommended plan review date.

In the absence of a summary, schedule a review appointment of your plan with your attorney, if you feel comfortable with the person. If not, choose a new planner who will take time to read over your plan and help explain it. Anticipate paying a fee for this review, but it will be money well spent.

Why do beneficiary designations need to be reviewed if you have an estate plan?

Some kinds of assets, always life insurance, retirement plans, and non-retirement annuity contracts, have death beneficiary designations on the various forms for the plan which state where the assets go when you die. These death beneficiary designations will bypass any inheritance designations in the estate plan. So if your estate plan states that your assets should be split equally between your three children, but you own a retirement plan with a death beneficiary designation that states your mother should receive the retirement assets, then your mother will receive those and not your children. Thus, you want to be sure to review these death beneficiary designations, especially for life insurance and retirement plans to be sure that they match the same people you name as heirs in your estate plan.

Preparing for your best year may include creating a Revocable Living Trust

A trust is a legal entity that can own property and provide certain benefits to the beneficiary. Think of a trust as a box in which you place certain assets. You don’t own the assets—but you do own the box. In most cases, the creator of a revocable living trust is also the beneficiary and the trustee. Read more in our article, What Fits Your Circumstances? A Will, a Trust, or Both? One benefit of a revocable living trust is that you only have to update the trust to ensure that it means your wishes for who should get what after you are gone. To make the best choice about the type of plan to use, find an estate planning attorney working in your state.

Let us know what you think of this episode by leaving a comment on our site.